Native Whey

Protein Trends: Why Consumers Want Natural & Sustainable Options

Traditional whey protein is the dominant force in the supplements market. But there’s a growing demographic of conscious consumers looking for products that provide transparency and more health-minded benefits. In this post, we break down the growing consumer demand for natural, sustainable protein and what it means for functional food and supplement manufacturers.

What Do Consumers Want?

Consumers are looking for more natural and easily digestible protein sources. The presence of a $16 billion plant protein market is testament to the fact that consumers want alternatives.

But this demand has also intersected with other consumer trends like transparency and sustainability.

As such, the interests of consumers are now more far-reaching than ever:

- Naturality

- Premium offerings

- Safe, fresh and ethically sourced ingredients

- Ingredient transparency

- Minimal processing

- No toxins, metals or added chemicals

- Manufacturing and processing transparency

- Easy to use

- Palatability for easy digestion

- Solubility for ease of use

- Better tasting protein products

- Efficacy and nutritional benefits

- Clearer, science-backed health benefits

- Lower calorie options

While their demands are diverse, a few things are abundantly clear: Consumers want higher quality products and a more natural way to achieve their protein goals. This is one of the biggest reasons native whey protein is gaining steam for manufacturers.

To show how these protein trends are impacting the demand for protein in global markets, let’s look at the rise of native whey.

Native Whey Protein

Native whey protein (NWP) is a pure, sustainable, minimally-processed protein that offers a neutral taste and more nutritional value compared to traditional whey and alternative protein products.

NWP is found naturally in fresh milk and isn’t a byproduct of the production of other products. It’s made exclusively using physical manufacturing processes, meaning no chemical processing or added ingredients are used.

How Does Native Whey Compare to Other Protein Forms?

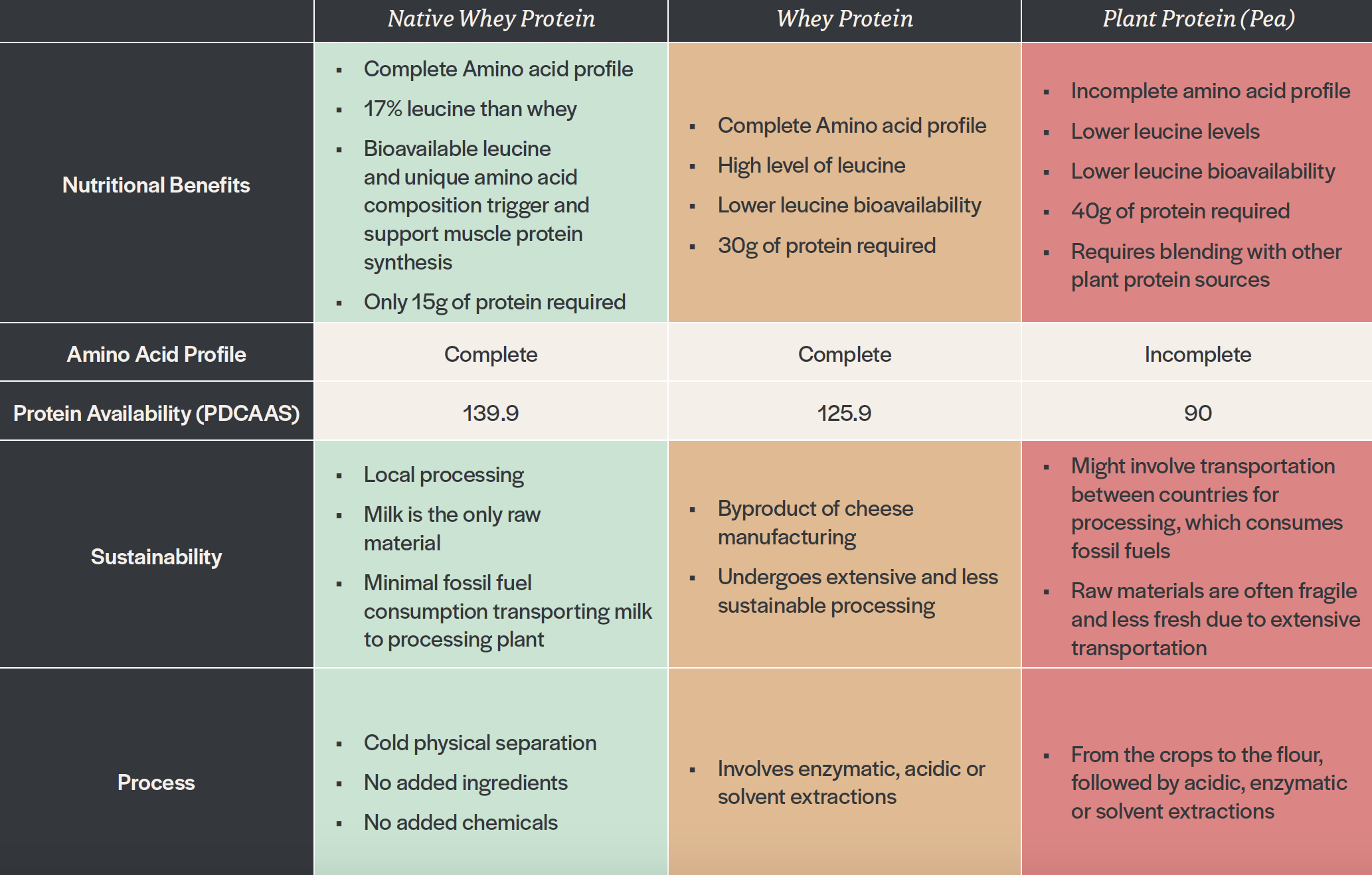

Compared to traditional whey or even plant-based whey protein, NWP offers a number of powerful benefits around recovery, amino acid production, protein availability and protein efficiency. This makes it ideal for fitness enthusiasts and people who consume protein powders and supplements regularly.

However, the implementation of new protein alternatives like NWP varies with geography, creating new challenges and opportunities in every market.

The European Market

The American market is the leader in setting trends for sports-and-active-lifestyle nutrition products. Consumer trends, demands and products primarily start in the U.S. and cross over to Europe. Within that market, the United Kingdom and Germany are the leaders, followed by Spain, Italy and the Nordic countries. And France is a small market for sports nutrition.

But for native whey, the dynamic is reversed. Awareness of NWP in the European market is significantly higher than in North America. And several French manufacturers are at the forefront of production. Here’s why.

Less Competition

The European market is less mature, with fewer supplement users and high protein products available than in the U.S. As such, there are fewer established brands selling traditional whey protein and lower barriers to entry for up-and-comers. This environment has created room for manufacturers to launch and differentiate premium native whey products without the typical constraints found in the U.S market.

Protein Purity

Consumers in Europe have demonstrated a strong interest in protein without lactose.

Recent research shows that lactose intolerance is very common, affecting anywhere from 20-79% of people, depending on ethnicity and ancestry. As such, many European consumers are turning to native whey to get the benefits of whey protein without lactose. Because NWP is so pure, the protein contains less lactose, fat and bacteriological residues than other proteins.

What “Native” Means

The term “native” is resonating better with consumers in the European market. For linguistic and cultural reasons, “native” has a direct link to “natural,” making it sound healthier and more in line with their expectations. It represents quality and answers overall concerns regarding clean products, minimal processing and zero additives.

Room for Education

The European market for native whey has also had time to develop. Manufacturers first started producing native whey in France 15 years ago. From there, the market expanded to the rest of Europe.

This has allowed ample time for the market to develop. And European manufacturers have been educating European consumers about the science and benefits of native whey for a long time. While the market is still young and meaningful data has yet to be produced, some estimates indicate Europe may make up 70% of the global market for NWP.

The North American Market

The United States is the global leader in sports and active nutrition, owning about 60% of global market share. This has led the North American whey protein market to become highly saturated, competitive and price-driven.

Additionally, the widespread popularity of traditional whey has contributed to a lack of awareness for NWP in the North American market. Education around the topic is still lagging – the first American clinical study was only recently published in March 2020.

From 2007 to 2010, ingredient manufacturers tried to introduce native whey into the U.S. market. But manufacturers felt the market was not ready for a premium ingredient without strong scientific evidence of nutritional superiority. It was then reintroduced in 2015, this time with a more scientific, evidence-based approach that relied on clinical studies proving its efficacy for manufacturers and consumers.

Sales started picking up as imports from France to the North American market increased. North American production of NWP soon followed in 2016, allowing manufacturers to purchase ingredients domestically.

Today, the American native whey market is still evolving, presenting both challenges and opportunities for manufacturers. The average athlete or fitness enthusiast in the U.S. isn’t familiar with the benefits of native whey. New entrants to the space will have to market to the right audience with the right message. This requires identifying niche value propositions and benefits that resonate.

On the other side of that challenge lies an opportunity. The American whey protein market is deeply saturated. But the market segment for premium, natural and quality protein supplements is largely untapped. As such, manufacturers entering the market will face less competition while simultaneously exposing their products to an entirely new demographic of users.

Conclusion

Consumers are changing the way they think about protein. The desire for nutrition, science, sustainability and efficacy will push manufacturers to produce new, innovative protein sources and products. The market is growing fast. And it’s loaded with opportunity for brands and manufacturers alike.

All Posts

All Posts